Why Europe Is Falling Behind In Innovation

Published September 2025

– Europe is falling behind in next-generation technologies that will shape future economic growth and global influence

– European startups struggle to scale due to weak venture capital, fragmented markets, and heavy regulatory burdens

– Without bold reforms, Europe risks slower growth, weaker productivity, and declining geopolitical influence

Europe is falling behind in the technologies that will shape future economic growth and global influence. While U.S. firms dominate artificial intelligence, semiconductors, and cloud computing, Europe remains underrepresented in next-generation industries and risks repeating its failure to capitalize on the first digital revolution, driven by the rise of the internet.

Former European Central Bank president Mario Draghi has called this an “existential challenge,” warning that the European Union’s (EU) weakness in emerging technologies threatens both prosperity and security.

The concern extends beyond innovation itself with aging populations driving up healthcare and pension costs, Europe needs stronger productivity gains to sustain growth and maintain its standard of living. Without bold reforms, the region risks eroding competitiveness, fiscal stability, and geopolitical influence.

A look at company formation illustrates Europe’s lack of innovation. For every European startup company with a valuation over a billion dollars, there are eight in the U.S. and four in China. Over the past 50 years, the U.S. created 241 companies with market capitalizations over $10 billion, while Europe created just 14.

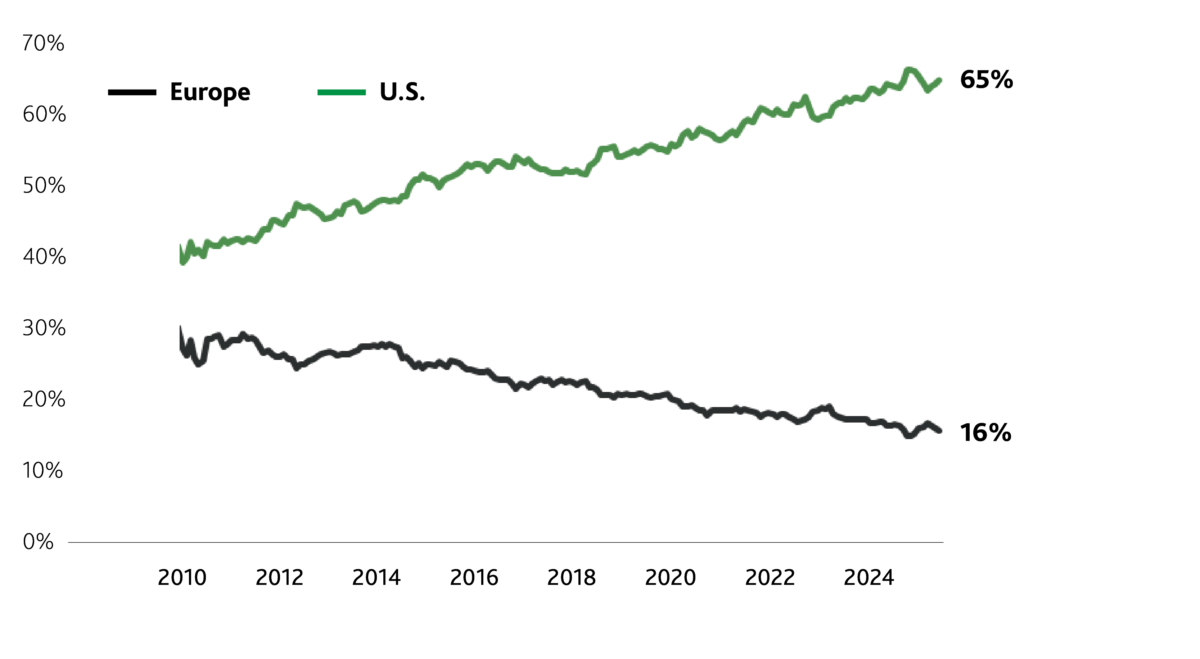

This divergence is also reflected in global equity indexes with the U.S. weight of the MSCI ACWI index rising from about 40% in 2010 to 65% today, while Europe’s weight has fallen from nearly 30% to 16%. The clearest sign of the innovation gap is that the combined market value of the four largest U.S. stocks (Nvidia, Apple, Microsoft, and Alphabet) exceeds that of the entire MSCI Europe index.

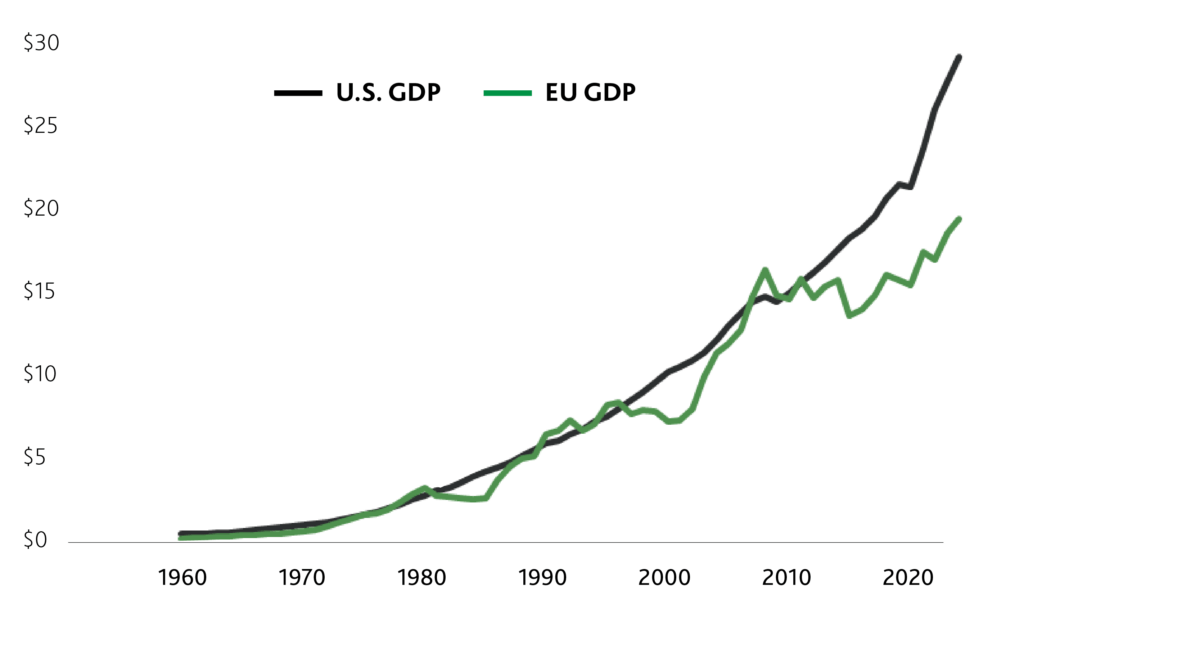

The consequences of Europe’s inability to create globally competitive technology companies and their accompanying productivity gains are already visible in economic performance. The U.S. economy is 50% larger than the EU after being a similar size 15 years ago, despite the U.S. having 25% less people.

In 2000, the average EU worker produced 95% of what an American worker produced per hour. Today, that number has fallen below 80%. On a per capita basis, real disposable income has grown nearly twice as much in the U.S. as in the EU since the turn of the millennium.

“Over the past 50 years, the U.S. created 241 companies with market capitalizations over $10 billion, while Europe created just 14.”

European investors and entrepreneurs say obstacles to building innovative companies are deeply entrenched such as suffocating regulations, strict labor laws, less venture capital, and a risk-averse business culture.

While the EU has prioritized consumer protection and data privacy through sweeping laws like the General Data Protection Regulation (GDPR) and the new AI Act, these rules also come with steep compliance costs. Nearly 90% of global firms report spending more than $1 million annually just to comply with GDPR, with 40% spending over $10 million.

These high compliance costs can deter new entrants and be prohibitive for smaller startup companies. Adding to the difficulty, Europe lacks a single unified market. Fragmentation across dozens of languages, labor laws, and tax systems creates significant challenges for businesses trying to scale across borders. In contrast, U.S. startups benefit from a single large, integrated market from day one.

Insufficient funding is another factor constraining European innovation. Because venture capital is critical to driving technology innovation, Europe’s funding shortfall poses a major obstacle to its innovation ecosystem.

According to a Financial Information Forum (FIF) survey, 70% of European venture capitalists viewed their fundraising environment as “bad” or “very bad”. Even though Europe has more technology startups than the U.S., American startups are 40% more likely to receive venture capital investment and that gap widens as companies mature.

Many promising European firms eventually relocate to the U.S. to secure the capital they need to scale, as venture capital investment in the U.S. is roughly five times larger than in Europe. Europe’s funding challenge is not limited to venture capital; governments and companies also invest less in research and development (R&D) than their U.S. peers.

In addition to underinvestment, Europe faces a structural challenge in how R&D resources are allocated. Much of Europe’s R&D remains concentrated in medium-technology industries such as automotive and traditional manufacturing, where innovation tends to focus on incremental product improvements rather than breakthrough advances.

By contrast, the U.S. has shifted its R&D efforts toward high-technology industries that generate faster growth, larger productivity gains, and more disruptive innovation. This imbalance has left Europe in what some economists describe as a “middle technology trap” since it is underrepresented in cutting-edge fields.

The age of Europe’s corporate champions reflects this reality as the average founding year of the 10 largest publicly traded companies is 1911, compared with 1985 for the U.S. The consequence is evident in patent activity, where the EU leads in automotive technologies but lags in critical areas such as technology hardware, software, and life sciences.

Draghi outlined an ambitious set of remedies such as easing regulatory burdens and increasing public investment in innovation, infrastructure, and defense. However, these proposals encountered strong political and institutional pushback.

Some member states oppose joint EU borrowing to finance large-scale spending, while entrenched national interests-from trade unions to industry lobbies-have resisted greater competition and integration within the single market.

As a result, even with broad recognition of the need to strengthen Europe’s competitiveness, political gridlock has slowed progress, leaving the region struggling to keep pace with global technological leaders.

The Widening Economic Divide Between the U.S. and Europe

U.S. & EU Annual GDP in U.S. Dollars (Trillions)

Europe’s Shrinking Share of Global Markets

MSCI ACWI Index Weight

by Dan Kupiec, CFA, Senior Investment Analyst and Jordan McGuire, Investment Analyst at MainStreet Advisors.