Streamline Portfolio Management with Turnkey and Personalized Portfolios

Watch our Fund Allocation Portfolios video below to see how it works and discover the benefits it can offer your clients.

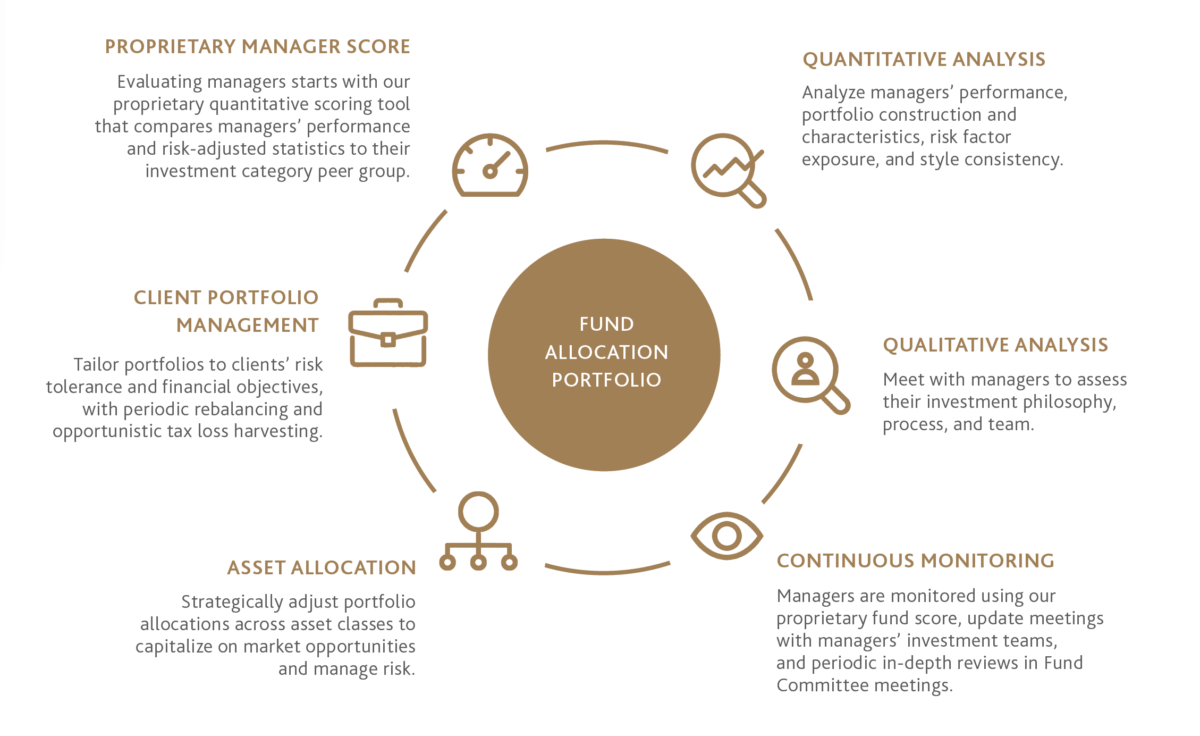

RIGOROUS RESEARCH PROCESS COMBINED WITH QUALITATIVE AND QUANTITATIVE ANALYSIS TO BUILD DIVERSIFIED PORTFOLIOS TO MEET CLIENTS’ PERSONALIZED NEEDS.

Our Fund Allocation Portfolios (FAP) provide clients with a powerful resource to simplify portfolio management.

FAP are constructed using a combination of mutual funds and ETFs or entirely ETFs, dependent on client circumstances. FAP can also incorporate our Seperate Account Management (SAM) portfolios of stocks and bonds in larger accounts.

Broad asset class diversification is obtained through equities, fixed income, and alternatives such as commodities, hedging strategies, private credit, and private equity.

A Powerful Resource for Managing Client Portfolios

GAIN VALUABLE TIME TO DEEPEN CLIENT RELATIONSHIPS, ENHANCE CLIENT SATISFACTION, AND FOCUS ON ACTIVITIES THAT DRIVE REVENUE GROWTH.

Ready to grow your business?

Contact us today to discover how to add MSA Fund Allocation Portfolios to your Investment Toolbox.